Distribution encompasses how Vermont farms and food manufacturers get products to consumers in the state and region. Without a robust and efficient distribution system that provides cost-effective options to get their products to market, Vermont farmers and food businesses will struggle to compete and capitalize on consumer demand for Vermont food. Consolidation in the distribution industry and resulting price pressures has created unfavorable financial terms for smaller producers and restricted their access to wholesale markets. This is happening as consumers are increasingly seeking source-identified products that are perceived to provide transparency, food safety, and positive community impact. More direct investment is needed for distribution infrastructure, technology, and technical assistance to introduce system efficiencies and make wholesale and regional markets accessible and viable for Vermont farmers and food producers.

Distribution models utilized by Vermont producers include self-distribution, freight shipping, wholesale distribution, and intermediated market distribution.

“Self-distribution” is when a producer delivers a product themselves, and often is the first way producers fulfill wholesale orders. “Freight shipping” providers simply charge for transportation services. Freight shipping accommodates e-commerce, allows producers to receive full retail prices while retaining control of sales accounts, and removes financial and logistical burdens of self-distribution. Freight is more widely available and cost-competitive for shelf-stable food products than for produce, meat, and dairy, which have stringent cold-chain requirements and need specialized packaging and/or refrigerated trucks.

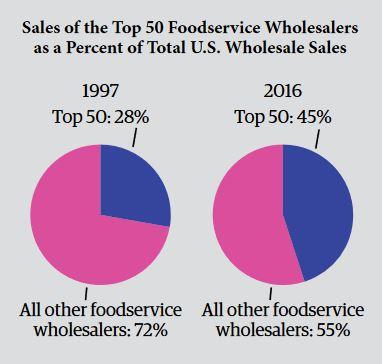

“Wholesale distributors” buy food products for resale and transport them to retail buyers. Producers can access new markets and increase sales volumes by using a wholesale distributor, but strong existing sales and high production volumes may be a prerequisite. These distributors face considerable pressure to keep prices low in order to retain market share in competitive retail and institutional markets. For producers this can mean low prices and hidden fees from distributors (see Grocers brief).

Because the wholesale distribution landscape is dominated by larger distributors who favor national food businesses, smaller produce, specialty food, and beverage wholesale distributors that operate in the state and Northeast are integral to the success of Vermont food businesses. These smaller distributors (food hubs, online distributor-retailers, and regional specialty distributors), which explicitly emphasize local food as part of their business, make up a part of what USDA calls “intermediated markets.”1 These intermediated market distributors are addressing the need for better prices for producers and the growing consumer and institutional demand for local food (see Consumer Demand, College and Hospital Procurement, School Food Procurement briefs).