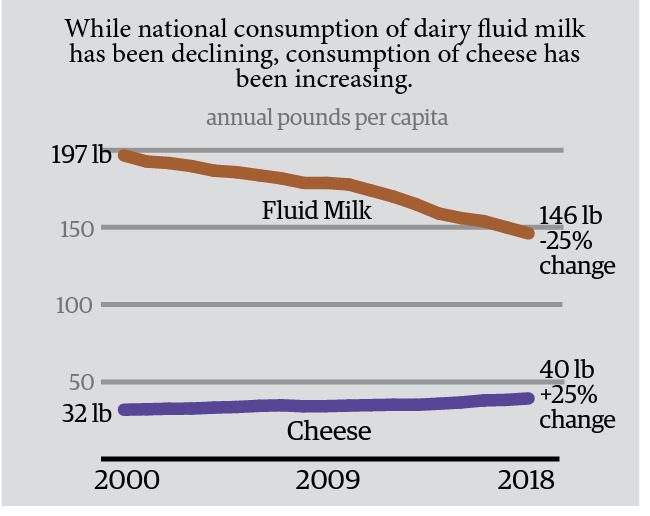

Vermont boasts more state-inspected cheese producers per capita than any other state in the nation — close to one cheese maker for 13,000 people — generating more than $657 million in annual revenue. Vermont cheese makers create superior quality cheeses, winning national and international awards in numbers disproportionate to the size of our state. It takes ten pounds of milk to make one pound of cheese, making cheese a more consistently profitable option than fluid milk for dairy farmers. Vermont’s small dairy farms, challenging terrain, and short growing seasons create a disadvantage for Vermont dairy farmers relative to other national dairy producers in the commodity market but can be used as an advantage for value-added producers. Environmental concerns and low milk prices continue to be a struggle for many dairy farmers; however, dairy farms and related processing are central to Vermont’s landscape and identity (see Dairy brief, Goats brief). A viable future for Vermont dairy needs to be premised on a strategy that compensates for these challenges and leverages Vermont strengths.

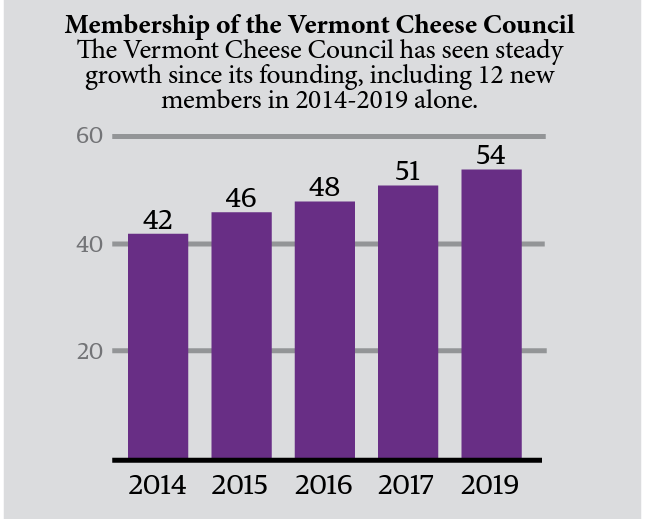

Vermont has been a cheese making state since the early days of the industry. Cabot Creamery Cooperative celebrated 100 years in 2019, and another large producer, Grafton Village Cheese, celebrated 127 years. Over the past three decades, the specialty cheese sector has developed rapidly, building on the success of Cabot and other well-known brands. In 1997, 19 people founded the Vermont Cheese Council as a response to market demand for specialty cheeses and built on Vermont farmers’ eagerness to adapt when opportunity presents itself.

Today, Vermont has over 60 cheese makers, with large-scale and smaller on-farm artisanal producers together making more than 225 varieties of cheese. From value-added on-farm dairy operations to purely cheese-making facilities, cheese making operations have tripled while family farm milk operations have steadily consolidated or disappeared.

For the most part, the Vermont commodity milk industry and the far smaller artisanal cheese-making industry do not operate in concert with one another, though they could and do in some cases. Due to dairy co-op policies and economies of scale, it is difficult for small cheese makers to source cheese-quality milk from the co-op system. This makes it very difficult for small cheese makers to establish themselves unless they are also prepared to be dairy farmers, and difficult for established farmstead cheese makers to grow because they are limited by their herd size and often cannot source additional off-farm milk to produce a larger volume of cheese.

Artisanal cheese makers require milk of exceptional quality. Much of this cheese is made with raw milk, which requires particular care in production and handling. A marketplace effectively optimized to make the highest-quality milk available to cheese makers would support much higher growth in Vermont premium cheese production.