Hemp is a versatile annual crop and, according to UVM research, is well adapted to Vermont’s climate. In 2018, federal laws established hemp as a regulated agricultural commodity. That year, United States hemp sales grew to $1.1 billion, dominated by cannabidiol (CBD), followed by personal care, food, and industrial products (e.g., building materials, textiles, bio-composites, etc.). From 2016-2018, the first Vermont farms and businesses that jumped in were rewarded with extraordinary prices for their high-CBD hemp. Market research shows the U.S. hemp industry will grow an estimated 19% from 2018-2022, however, as prices paid to producers continue to fluctuate, it is critical that Vermont’s hemp sector prepare for where prices are headed, look to the future, diversify, and innovate.

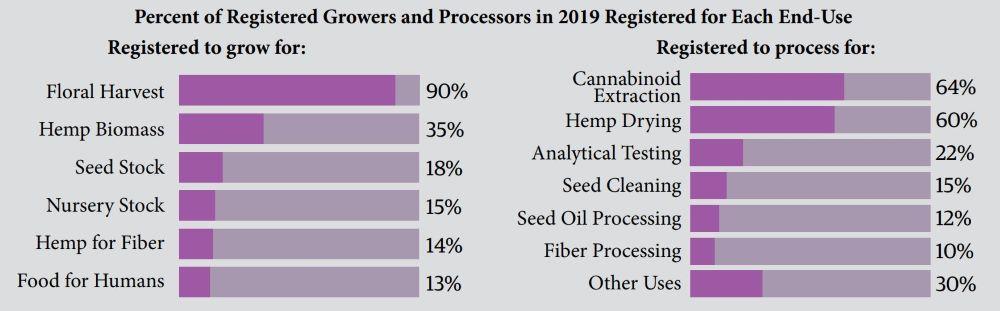

In the United States, hemp is cultivated for its grain (seed), fiber, or cannabinoids (hemp’s beneficial compounds, principally CBD). Vermont’s hemp sector has expanded rapidly, driven by U.S. sales of $390 million for CBD products in 2018. By 2019, cannabinoid production was the focus of 90% of registered Vermont hemp growers, followed by those growing hemp for seed or nursery stock, fiber, food, or “other.” Among Vermont’s 2019 hemp processors, most plan to dry hemp and/or extract its cannabinoids (64%). Another approximately 22% registered to explore seed oil or fiber processing, however, infrastructure and markets lag for these applications.

High-quality Vermont hemp biomass for CBD extraction was selling for $100-$150 per pound (net profit of approximately $80,000-$130,000 per acre) in 2018. As a result, successful 2018 operations expanded in 2019 and a flood of new registrants more than doubled the size of Vermont’s hemp program. By November 2019, prices everywhere had dropped sharply to $25-$55 per pound. For those growers that rushed in unprepared, lacked a buyer, or harvested too late, 2019 will likely be a setback. Others who had the knowledge, a processing plan, and perhaps a sales contract, will do well.

As 2019 wraps up and Vermont measures its progress, the hemp industry faces regulatory headwinds brought on by USDA Interim Final Rule on the US Domestic Hemp Production Program and uncertainties about what steps the Food and Drug Administration will take to regulate CBD in 2020.